The Importance of Decentralized Trading Platforms vs Centralized Exchanges in 2024

Discover why decentralized trading platforms are surpassing centralized exchanges in 2024. Explore benefits like security, autonomy, and low fees.

Cryptocurrencies are gaining increasing traction as a legitimate asset class, with a market capitalization of over $2.39 trillion as of July 2024. As this industry continues to grow, so does the need for reliable methods of buying, selling, and trading cryptocurrencies.

While centralized exchanges (CEXs) have been the go-to option for over a decade, decentralized trading platforms are rapidly emerging as a compelling alternative to the shortcomings of centralized crypto trading.

This article explores the growing importance of decentralized trading platforms versus CEXs in 2024 and beyond, arguing that decentralized exchanges offer significant advantages regarding security, user autonomy, and overall alignment with core cryptocurrency principles.

What are Decentralized Trading Platforms?

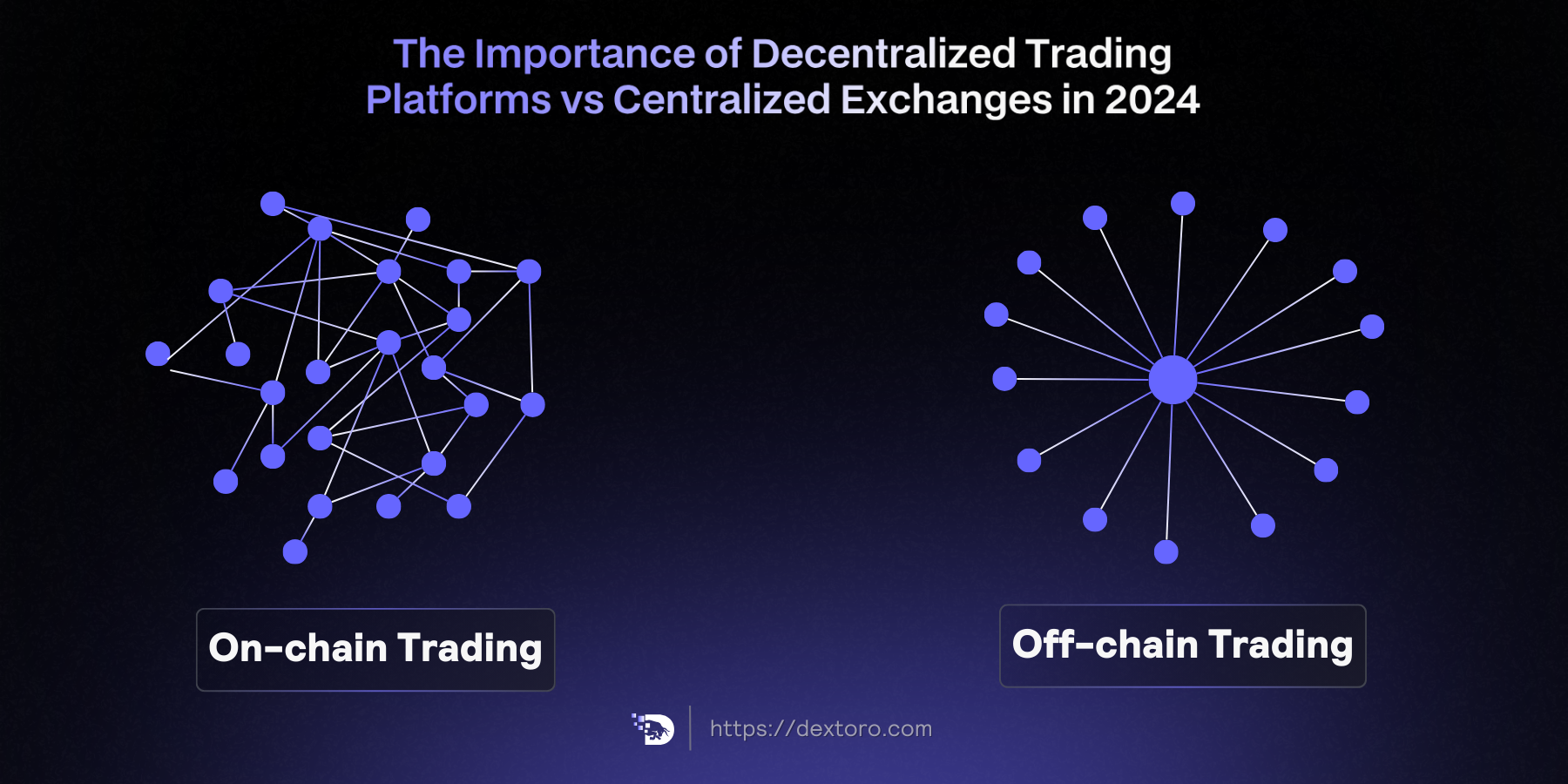

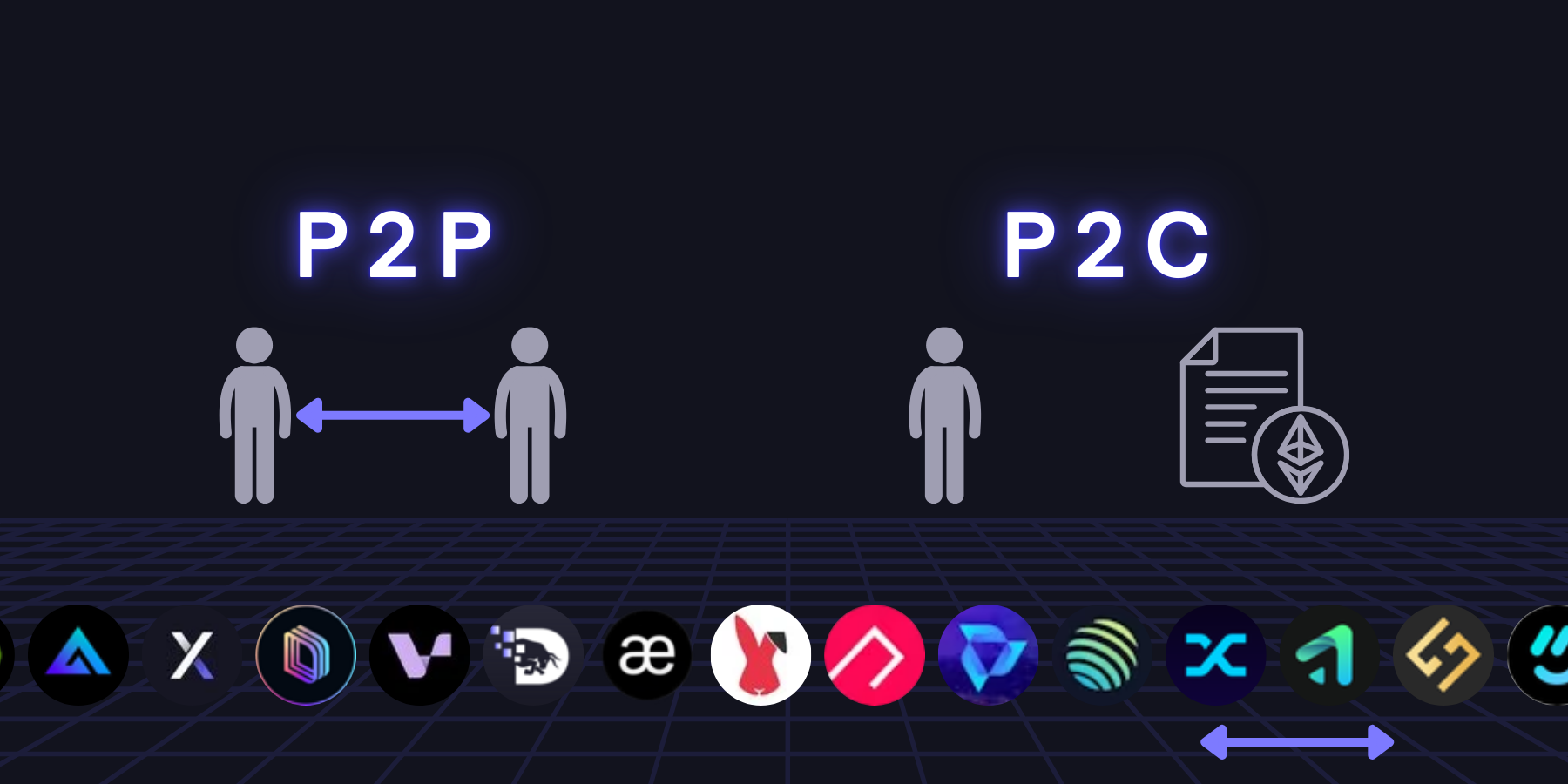

Decentralized trading platforms—otherwise known as decentralized exchanges (DEXs)—have emerged as a promising alternative to centralized exchanges as they offer a more secure, transparent, and user-controlled trading experience. DEXs operate on blockchain trading technology, enabling peer-to-peer or peer-to-contract trading without the need for intermediaries.

Pros of Decentralized Trading Platforms

Let's look at some of the benefits of using DEXs and why they are gaining popularity:

Decentralization

The most significant advantage of DEXs is their decentralized nature. They operate on blockchain networks, enabling peer-to-peer blockchain trading without central authority controlling the process. This puts the power back into the hands of users, in line with the original principles of cryptocurrency.

Greater Security

DEXs significantly improve security by eliminating centralized custody of user funds. Instead, DEXs leverage smart contracts for peer-to-peer transactions directly on the blockchain. This approach removes the single point of failure associated with centralized exchanges, reducing the risk of large-scale hacks.

Users maintain control of their private keys throughout trading, adhering to the fundamental cryptocurrency principle of user sovereignty over assets. This "not your keys, not your coins" ethos ensures traders retain full ownership and responsibility for their funds.

Anonymity and Privacy

Unlike CEXs with strict KYC/AML regulations, most DEXs do not require users to undergo identity verification processes. To start trading, users need only a crypto wallet, some funds, and an internet connection.

Since DEXs do not require users to complete KYC or AML procedures, users can trade cryptocurrencies without revealing personal information. This level of privacy is particularly attractive to users who value anonymity and want to keep their financial activities confidential.

Lower Fees

While centralized exchanges often impose substantial fees for withdrawals and trades, sometimes reaching $10 or more per transaction, DEXs frequently charge only fractions of a cent for similar actions. This stark difference in fee structure can result in substantial savings, especially for frequent traders or those dealing with larger volumes.

Censorship Resistance and Global Accessibility

Decentralized trading platforms leverage blockchain technology's distributed nature to achieve unparalleled censorship resistance. Operating across thousands of global nodes, DEXs create a resilient trading infrastructure highly resistant to interference or shutdown attempts.

This architecture ensures that no single authority can easily disrupt operations or restrict access, allowing users to trade freely even in regions with strict regulations or during political instability.

Cons of Decentralized Trading Platforms

However, decentralized trading platforms are not yet the perfect solution for all trading needs:

Lower trading volumes

DEXs often have lower trading volumes, which can result in larger price spreads and slippage during trades. This can be particularly noticeable for less popular or newly listed tokens. It's important to look for a DEX with sufficient trading activity in your preferred tokens to ensure that you can execute trades efficiently.

Trading volume on Dextoro is increasing monthly, with $100 million in trading volume recently reached as of July 2024. It's a snowball effect — as more users join DEXs, the trading volume will continue to grow, enhancing liquidity and reducing the impact of lower volumes.

User experience

While decentralized trading platforms have significantly improved user experience, they may still be less intuitive and user-friendly than CEXs. Some DEXs require users to interact with smart contracts directly, which can be intimidating for novice users.

DexToro offers a streamlined onboarding process, clear navigation, and tooltips to guide users through various features. There are even advanced trading tools typically found on centralized exchanges, such as one-click trading, customizable charts, and various order types.

Limited fiat currency support

Most DEXs facilitate cryptocurrency-to-cryptocurrency trading, and users often need to rely on CEXs or other on-ramps to convert fiat currencies into cryptocurrencies before using DEXs. This limitation can be a barrier for users who prefer to trade directly with fiat currencies.

What are Centralized Exchanges (CEXs)?

To understand why decentralized trading platforms have gained traction, it's essential also to understand centralized exchanges (CEXs) and their role in the cryptocurrency ecosystem. Some popular examples of CEXs include Coinbase, Binance, and Kraken.

In contrast to decentralized exchanges, CEXs are operated by a central authority that controls users' funds. This centralized model provides convenience for users as they don't need to worry about managing private keys or interacting with smart contracts.

Pros of Centralized Exchanges

Let's look at some of the advantages that centralized exchanges offer:

User-friendly

Centralized exchanges excel in providing an accessible entry point to cryptocurrency trading. Users simply create an account, deposit funds, and start trading. There's no need to worry about technical aspects such as private keys or wallet management, making it easy for beginners to get started.

High Liquidity

With many active buyers and sellers, these platforms ensure that trades can be executed quickly and at competitive prices. This depth of market leads to several benefits: faster trade execution, lower price slippage (especially for larger orders), and a more efficient price discovery process.

Fiat On-Ramps and Off-Ramps

One barrier to adoption in the cryptocurrency space is the difficulty in buying digital assets. Centralized exchanges address this challenge through comprehensive fiat on-ramps and off-ramps.

These platforms typically support bank transfers, credit/debit cards, and often region-specific options like ACH, SEPA, or popular e-wallets. This integration allows users to easily convert between fiat currencies and digital assets, significantly lowering the entry barrier for newcomers.

Cons of Centralized Exchanges

The convenience of centralized exchanges comes at a cost. Let's explore some of the drawbacks:

Lack of Privacy

CEXs require users to provide personal information during registration, including name, address, and often government-issued ID for verification. All trading activity is tied to an individual's identity and can be accessed by the exchange or potentially shared with government agencies.

This intrusion sharply contrasts the pseudonymity and privacy offered by decentralized exchanges like Dextoro that don't require personal information to use the platform.

Lack of Transparency

The opaque nature of centralized exchanges' operations can mask potential issues until too late. The FTX bankruptcy case revealed that even seemingly successful and reputable exchanges might engage in questionable practices.

Users often have limited insight into how their funds are used or managed. If the exchange faces financial difficulties or engages in fraudulent activities, this can lead to unexpected losses.

Centralized Control

Exchanges can freeze accounts, block withdrawals, or even shut down entirely, potentially leaving users without access to their assets. This centralization of power runs counter to the decentralized ethos that underpins much of the cryptocurrency movement.

Celsius, a popular crypto lending platform, abruptly froze user withdrawals in June 2022 before filing for bankruptcy the following month. Subsequent investigations revealed mismanagement of user funds and engagement in risky investment strategies without proper disclosure to customers.

Higher Fees

Centralized exchanges typically charge fees for every trade, deposit, and withdrawal. For example, a popular CEX might charge a 0.5% trading fee, a 3% fee for credit card deposits, and a flat $10 fee for cryptocurrency withdrawals. These costs can quickly accumulate, especially for frequent traders or those dealing with larger sums.

Growth and Adoption of DEXs in 2024

The year 2024 has marked a turning point in the adoption and growth of decentralized exchanges, driven by a convergence of technological advancements, market demand, and evolving regulatory landscapes.

Technological Innovations

Technological innovations have been at the forefront of this growth. New layer-2 solutions have significantly improved performance, scalability, and user experience. These advancements have effectively addressed previous challenges of decentralized blockchain trading, such as high gas fees and slow transaction times.

For instance, optimistic rollups and zero-knowledge proofs have dramatically reduced transaction costs and increased throughput on Ethereum-based decentralized trading platforms. At the same time, newer blockchain networks designed for DeFi have enabled near-instant, low-cost trades.

DeFi Ecosystem Expansion

The expanding decentralized finance (DeFi) ecosystem has been a major catalyst for DEX adoption. Users are increasingly drawn to the innovative financial products offered by DeFi platforms, such as yield farming, liquidity mining, and decentralized lending. DEXs are the primary gateway for accessing these services, driving significant traffic and liquidity to these platforms.

Regulatory Developments

As governments and financial authorities grapple with the rapid evolution of crypto markets, many have recognized the potential benefits of decentralized systems in terms of transparency and reduced systemic risk. This has led to more favorable regulatory environments in several jurisdictions, encouraging retail and institutional participation in DEX markets.

Interoperability and Future Outlook

The development of cross-chain bridges and protocols has enabled seamless trading across different blockchain networks, significantly expanding the scope and liquidity of DEXs. This interconnectedness has created a more robust and diverse trading ecosystem, attracting users from various blockchain trading communities.

As DEXs continue to evolve and mature, they are increasingly seen as alternatives to centralized exchanges and as the future of crypto trading. Their growth in 2024 reflects a broader shift towards decentralized, user-controlled financial systems, aligning closely with the original vision of cryptocurrencies.

Balancing User Experience and Decentralization

DEXs must strike a delicate balance between maintaining the core principles of decentralization and providing a seamless user experience. Ongoing UI/UX design efforts and the development of user-friendly interfaces will be crucial in making DEXs accessible to a broader user base.

DexToro's one-click trading feature is an excellent example of enhancing user experience while maintaining decentralization. By allowing users to execute trades with a single click, DexToro has eliminated the need to sign wallet confirmations while still ensuring the security of funds.

Decentralized trading platforms are designed to prioritize privacy and resist censorship. However, to ensure their long-term viability, DEXs may need to proactively dialogue with regulators and develop innovative solutions that meet regulatory requirements without compromising decentralization.

DexToro: Setting A New Standard for DEXs

While numerous decentralized exchanges have emerged in recent years, many still grapple with restricted trading options, poor useability, and liquidity issues. DexToro, however, stands out as a pioneering force in innovative solutions to address these common pain points.

At the core of DexToro's revolutionary approach is its peer-to-contract (P2C) trading engine. This cutting-edge technology enables:

- Infinite Liquidity: Traders can execute orders of any size without concerns about depth.

- Zero Slippage: Ensures executed prices match expected prices, enhancing trade precision.

- Minimal Price Impact: Large trades can be executed without significantly affecting market prices.

DexToro's comprehensive offering extends beyond typical crypto pairs, encompassing forex and commodities. This diversity, combined with up to 50x leverage, empowers traders to capitalize on a wide range of market opportunities and amplify their returns.

The platform is equipped with an array of sophisticated trading tools:

- One-click Trading: For swift execution in fast-moving markets.

- Advanced Order Types: Users can enjoy take-profit and stop-loss for risk management.

- Precision Price Feeds: Leveraging Pyth oracles for accurate and reliable market data.

By combining these features with a commitment to decentralization, DexToro is not just participating in the DEX revolution — it's leading it, setting new standards for what traders can expect from decentralized financial platforms.

DexToro's Transition to a Full-Fledged Blockchain Protocol

But that's not all — DexToro has recently transitioned from a standalone decentralized exchange to a comprehensive blockchain protocol. The transition to a blockchain protocol opens up a new world of possibilities for DexToro and its users:

- Expanded Ecosystem: DexToro now offers a suite of interconnected products, including an on-chain self-custodial derivatives exchange, an upcoming collateral-backed dUSD stablecoin, and multi-chain liquidity for permissionless derivatives trading.

- Enhanced Accessibility: The protocol aims to democratize access to financial opportunities, allowing anyone, regardless of location or background, to benefit from decentralized derivatives trading.

- Liquidity for Permissionless Derivatives: The upcoming Liquidity product will support perpetual futures, options, and parimutuel markets across multiple EVM chains — ensuring deep liquidity pools and seamless trading on users' preferred blockchains.

- Institutional Integration: With upcoming Enterprise solutions, DexToro is poised to attract institutional clients that drive greater adoption and liquidity to the platform.

As DexToro embarks on this new chapter, it stands ready to meet the growing demand for decentralized derivatives trading, estimated to be worth over $2.95 trillion as of March 2023. It's an exciting time for the platform and its users as DexToro continues leading the decentralized trading revolution.